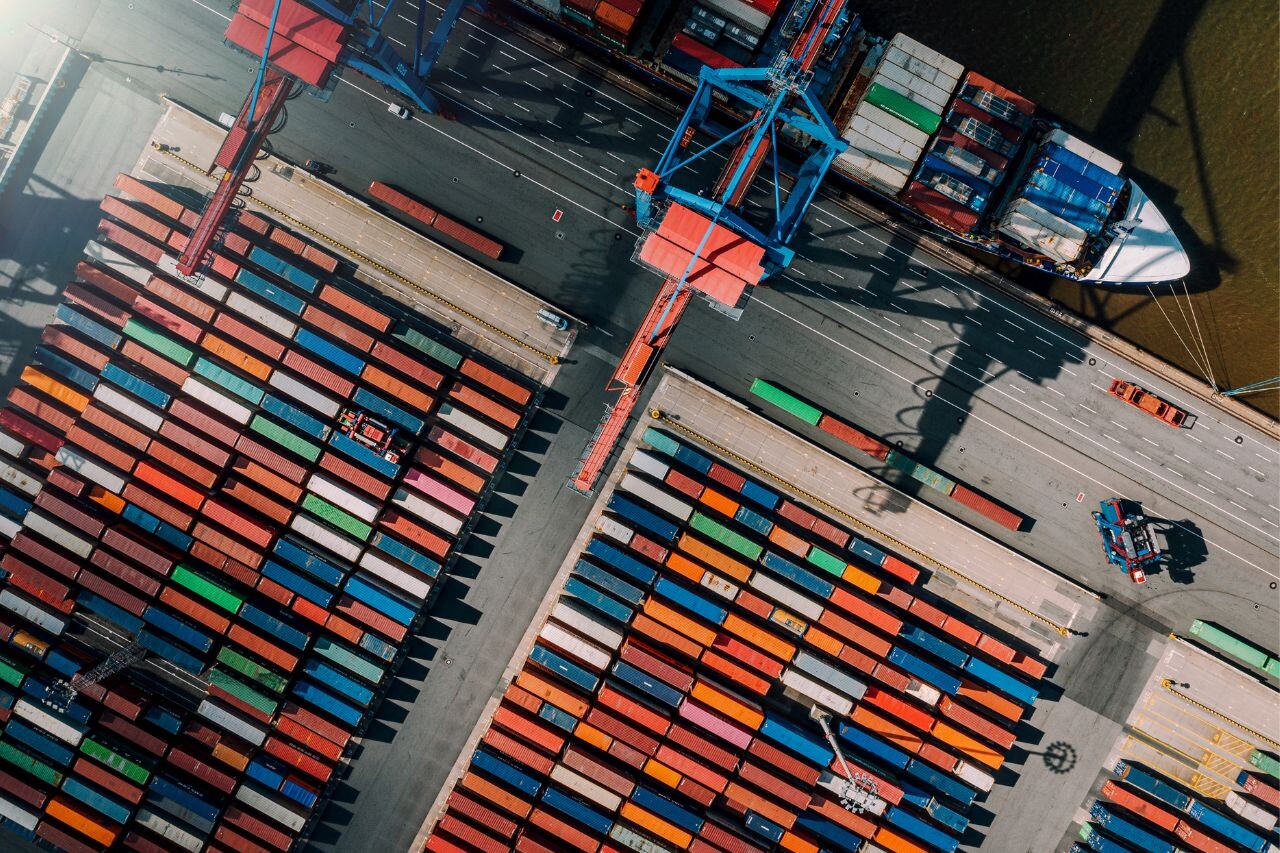

Why is Cambodia an ideal location to set up a factory?

The first phase of the Yangtze River Delta Special Economic Zone covers an area of 300 hectares, and the second phase covers an area of 450 hectares. It is one of the largest special economic zones in Cambodia.

Cambodia is a popular location for production facilities due to its relatively low labor costs, favorable government policies and trade agreements, and proximity to major markets such as China and the United States. In addition, the country has a large and growing young workforce, as well as a large number of workers with experience in the manufacturing industry. Cambodia is also a member of various trade agreements, such as those of ASEAN, the World Trade Organization, and the European Union, which allow for quota-free exports to these markets and enjoy customer tariff reductions. These factors make it an attractive location to establish and operate production facilities.

Cambodia Information Overview

181Kilometer

Land Area

17.2Million

population

25Year

Average age

2.5%

Inflation rate

87.9Billion

GDP 2022

200$

Minimum wage

8 investment advantages of Cambodia

No foreign exchange controls

Cambodia does not have strict foreign exchange controls, which makes it relatively easy to move money in and out of the country. This is an important factor for companies looking to set up production facilities in Cambodia, as it allows them to easily manage their finances and obtain foreign exchange when needed.

Low social security rate

Cambodia has relatively low social security rates, which helps keep labor costs low for companies looking to establish production facilities in the country. Cambodia's social security contributions consist of three main components: pensions, health, and unemployment. Compared to other countries, Cambodian employers have a low contribution rate of about 4-5% of employee wages, which is significantly lower than other countries.

USD Trading

Cambodia conducts transactions primarily in U.S. dollars, which is beneficial for companies looking to establish production facilities in the country. Using the U.S. dollar as the primary currency for trade helps reduce currency risk and makes it easier to manage financial transactions. Additionally, using the U.S. dollar allows companies to more easily compare costs and prices with those in other countries.

Monthly minimum wage: $200

Cambodia has a relatively low monthly minimum wage, currently set at around $200. This can be an attractive factor for companies looking to establish production facilities in the country, as it means that labor costs are relatively low. Low labor costs can help companies keep production costs low and increase profitability. Additionally, it can help companies remain competitive in product pricing.

Preferential tariff treatment

As part of its trade policy, Cambodia offers reduced tariff rates on certain goods. These reduced rates may apply to goods that are considered necessary or locally produced. In addition, Cambodia has trade agreements with other countries that allow for reduced tariffs on certain goods imported from those countries.

Abundant manpower

Cambodia has abundant manpower, with a population of over 16 million and a relatively low median age of 27.5 years. The country's workforce is characterized by a large number of young, educated and relatively low-cost workers. This makes Cambodia an attractive destination for companies looking to outsource labor-intensive manufacturing and assembly operations. The garment and textile industry is the country's largest employer, followed by tourism and construction.

Quasi-National Treatment

Quasi-national treatment (QNT) is a principle that allows foreign companies to be treated as domestic companies in certain circumstances. In the case of Cambodia, QNT is usually included in bilateral investment treaties and free trade agreements that the country has signed with other countries. The purpose of QNT is to provide a degree of protection and predictability for foreign investors in Cambodia and to encourage foreign investment in the country.

Low business income tax

New factories can enjoy a 6-9 year corporate income tax preferential period. During the preferential period, they are exempt from corporate income tax. After the preferential period ends, the local tax department will conduct a tax assessment on the enterprise. If approved, the enterprise will be given a 75% tax exemption for 3 years. After the 3-year period, another assessment will be conducted and another 50% exemption will be given... and so on.

Cambodia Investment Environment

Cambodia's Socio-Cultural Environment: A Glimpse into the Diverse Charms of Asia's Treasure CountryCambodia is a unique and diverse country with a rich and varied socio-cultural environment. An in-depth understanding of Cambodian society and culture reveals lifestyles, values and traditional customs. Cambodian socio-culture covers language, history, ethnicity, and so on.Read More

Cambodia's Socio-Cultural Environment: A Glimpse into the Diverse Charms of Asia's Treasure CountryCambodia is a unique and diverse country with a rich and varied socio-cultural environment. An in-depth understanding of Cambodian society and culture reveals lifestyles, values and traditional customs. Cambodian socio-culture covers language, history, ethnicity, and so on.Read More A Complete Guide to Foreign Investment and Mergers and Acquisitions in Cambodia: Key Regulations, Steps and Practical AdviceWhat is the information required for foreign investment in Cambodia? What are the applicable laws and regulations? What are the required documents and materials? A detailed guide to foreign investment and mergers and acquisitions in Cambodia, including regulations, investment procedures and advice.Read More

A Complete Guide to Foreign Investment and Mergers and Acquisitions in Cambodia: Key Regulations, Steps and Practical AdviceWhat is the information required for foreign investment in Cambodia? What are the applicable laws and regulations? What are the required documents and materials? A detailed guide to foreign investment and mergers and acquisitions in Cambodia, including regulations, investment procedures and advice.Read More Comprehensive Guide to Employment and Labor Laws in CambodiaWould you like to understand Cambodian employment and labor laws? If you are considering hiring foreign workers in Cambodia, understanding the eligibility criteria, procedures for applying for work permits and visas, and hiring foreigners will help your business!Read More

Comprehensive Guide to Employment and Labor Laws in CambodiaWould you like to understand Cambodian employment and labor laws? If you are considering hiring foreign workers in Cambodia, understanding the eligibility criteria, procedures for applying for work permits and visas, and hiring foreigners will help your business!Read More Ho Chi Minh City-Mo Bai Expressway: Boosting Economic Growth in Southern Vietnam and CambodiaThe Ho Chi Minh City-Mo Bai Expressway is a major infrastructure project in southern Vietnam aimed at improving connectivity and facilitating trade with Cambodia.Read More

Ho Chi Minh City-Mo Bai Expressway: Boosting Economic Growth in Southern Vietnam and CambodiaThe Ho Chi Minh City-Mo Bai Expressway is a major infrastructure project in southern Vietnam aimed at improving connectivity and facilitating trade with Cambodia.Read More The Impact of Chinese Tariffs and Trade Wars on the Global Economy - Why You Should Consider Investing in Cambodia?Want to understand the impact of China's tariffs and trade wars on the global economy? The global economy is a complex web of interconnected trade relationships.Read More

The Impact of Chinese Tariffs and Trade Wars on the Global Economy - Why You Should Consider Investing in Cambodia?Want to understand the impact of China's tariffs and trade wars on the global economy? The global economy is a complex web of interconnected trade relationships.Read More Special Economic Zones in Cambodia: The Complete GuideSpecial economic zones have become a common feature of economies around the globe, providing an environment with unique advantages and regulations for businesses to encourage investment and growth.Read More

Special Economic Zones in Cambodia: The Complete GuideSpecial economic zones have become a common feature of economies around the globe, providing an environment with unique advantages and regulations for businesses to encourage investment and growth.Read More

Cambodia Policy and Law

Cambodia's Trade Agreement Act (TAA): a powerful tool for trade and investment promotionThe Trade Agreements Act (TAA) is the legal framework for international trade, which aims to create a fair and favorable trading environment between countries. The main aspect is the reduction or elimination of tariffs and is the most familiar part of TAA.Read More

Cambodia's Trade Agreement Act (TAA): a powerful tool for trade and investment promotionThe Trade Agreements Act (TAA) is the legal framework for international trade, which aims to create a fair and favorable trading environment between countries. The main aspect is the reduction or elimination of tariffs and is the most familiar part of TAA.Read More Investing in Cambodia: Understanding Cambodian Investment Laws & RegulationsIn recent years, Cambodia has been attracting more foreign investments by enacting and amending a series of laws and regulations, including the Law on Investment and the Law on Commercial Enterprises, which regulate, mainly in the form of laws, simplify the investment procedures and shorten the approval process.Read More

Investing in Cambodia: Understanding Cambodian Investment Laws & RegulationsIn recent years, Cambodia has been attracting more foreign investments by enacting and amending a series of laws and regulations, including the Law on Investment and the Law on Commercial Enterprises, which regulate, mainly in the form of laws, simplify the investment procedures and shorten the approval process.Read More The Complete Guide to Setting Up a Business in Cambodia: How to Successfully Apply for a License and Resolve Local RegulationsCambodia has become a popular destination for entrepreneurs and investors to set up businesses in Southeast Asia. With its growing economy, favorable investment policies and relatively low cost of living, Cambodia is an attractive option for those seeking to start a business.Read More

The Complete Guide to Setting Up a Business in Cambodia: How to Successfully Apply for a License and Resolve Local RegulationsCambodia has become a popular destination for entrepreneurs and investors to set up businesses in Southeast Asia. With its growing economy, favorable investment policies and relatively low cost of living, Cambodia is an attractive option for those seeking to start a business.Read More